Monsanto Nixes Property Tax Deal with Pima County; Will Build Greenhouse

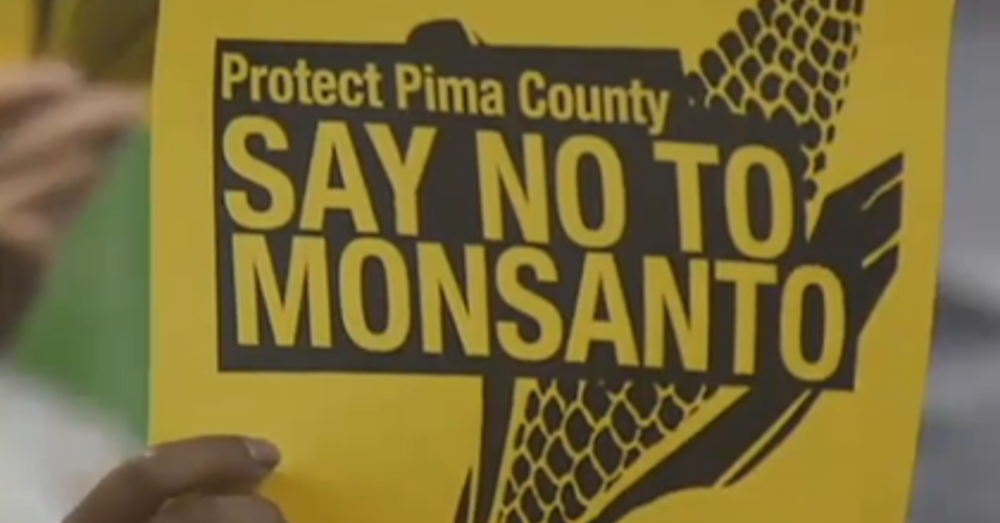

The agribusiness giant Monsanto has withdrawn its proposal for a property tax arrangement with Pima County that would have substantially reduced property tax payments at a planned greenhouse near Marana.

February 15, 2017 | Source: Tucson.com | by Murphy Woodhouse, Arizona Daily Star

The agribusiness giant Monsanto has withdrawn its proposal for a property tax arrangement with Pima County that would have substantially reduced property tax payments at a planned greenhouse near Marana.

That’s according to a Feb. 15 letter sent to the county by government affairs director George Gough.

“I am writing to inform you that after much thought, the Monsanto Company has decided to withdraw our Foreign Trade Zone Payment In Lieu of Taxes Agreement proposal scheduled for consideration by the Pima County Board of Supervisors at their February 21, 2017 meeting,” the letter reads.

“Monsanto Company remains committed to partnering with the community in Pima County and we look forward to working with you in the future,” it goes on to say.

In response, County Administrator Chuck Huckelberry requested that all of the items slated for discussion next Tuesday be removed from the supervisors’ agenda.

Monsanto said in an email that it was going to continue with the project to build and operate the greenhouse to grown corn on seven acres of land near Marana. Monsanto has already purchased 155 acres at the intersection of Twin Peaks and Sanders roads.

A company official said it would move forward with its commitment to the area, including a contribution in lieu of lower property taxes of $500,000 to the Marana Unified School District Foundation, creating a community advisory panel and to voluntarily report the usage of restricted-use pesticides at the greenhouse.

The supervisors were to consider whether to support Monsanto’s application for foreign-trade-zone status, which would substantially reduce its property tax burden over the next 10 years. In exchange for receiving that support, the company would commit to spending at least $90 million on the development and hiring at least 50 people at an average salary of roughly $44,000.

A foreign-trade-zone designation would drop the property’s assessment ratio from 15 percent to 5 percent. The annual difference in property taxes paid to the county after $96 million in development would be around $370,000 lower with the FTZ rate, documents show.