The Sobering Details Behind the Latest Seed Monopoly Chart

When Philip Howard of Michigan State University published the first iteration of his now well-known seed industry consolidation chart in 2008, it starkly illustrated the extent of acquisitions and mergers of the previous decade: Six corporations dominated the majority of the brand-name seed market, and they were starting to enter into new alliances with competitors that threatened to further weaken competition.

January 11, 2019 | Source: Civil Eats | by Kristina Hubbard

As four seed companies now control more than 60 percent of the global market, a seed policy expert argues that consolidation poses major risks to our food supply.

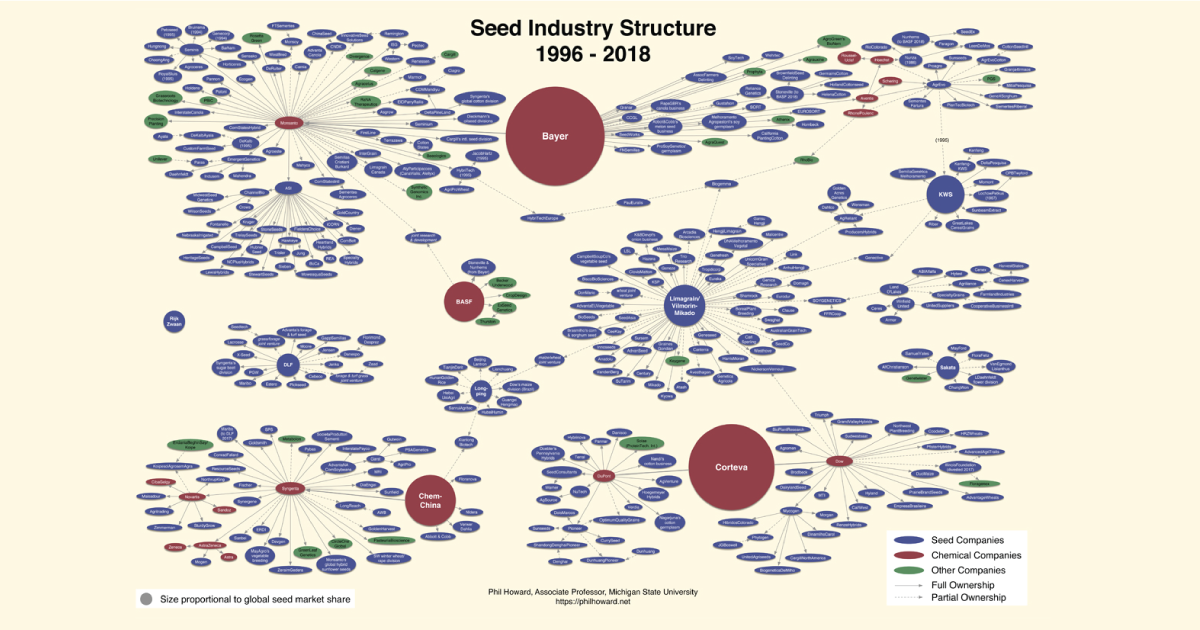

When Philip Howard of Michigan State University published the first iteration of his now well-known seed industry consolidation chart in 2008, it starkly illustrated the extent of acquisitions and mergers of the previous decade: Six corporations dominated the majority of the brand-name seed market, and they were starting to enter into new alliances with competitors that threatened to further weaken competition.

Howard’s newly updated seed chart is similar but even starker. It shows how weak antitrust law enforcement and oversight by the U.S. Department of Justice (DOJ) has allowed a handful of firms to amass enormous market, economic, and political power over our global seed supply. The newest findings show that the Big 6 (Monsanto, DuPont, Syngenta, Dow, Bayer, and BASF) have consolidated into a Big 4 dominated by Bayer and Corteva (a new firm created as a result of the Dow–DuPont merger), and rounded out with ChemChina and BASF.